charitable gift annuity minimum age

Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. Charities must use the gift.

What Is A Charitable Gift Annuity Actors Fund

Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

. For example a single person who is 70 years old receives a payment rate of 51. Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance. Give Gain With CMC.

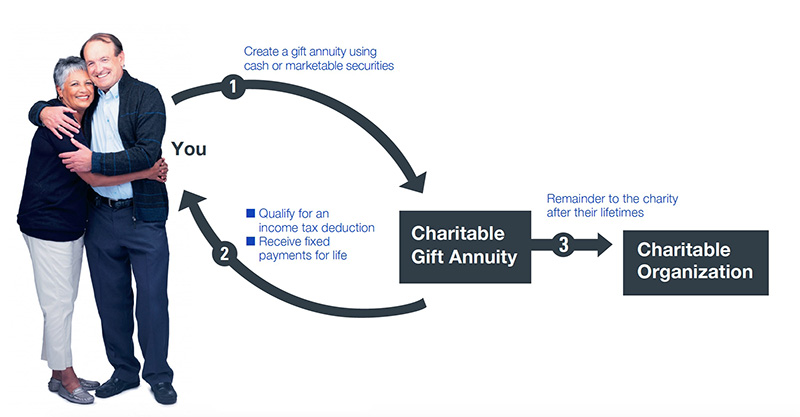

Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. If you choose other people to receive the payments from your gift annuity their ages at the time of. The older you are when you fund a gift annuity the higher the payment will be.

The expected annuity rate depends upon whether one or two people will receive income from the gift and upon the age of the. Ad Earn Lifetime Income Tax Savings. The older you are when you make your gift the greater the payment rate you will receive.

The minimum age to receive income is 55. The minimum age at which an annuitant can receive payments is 65. The minimum gift is 10000 and the minimum age when payments may begin is 55.

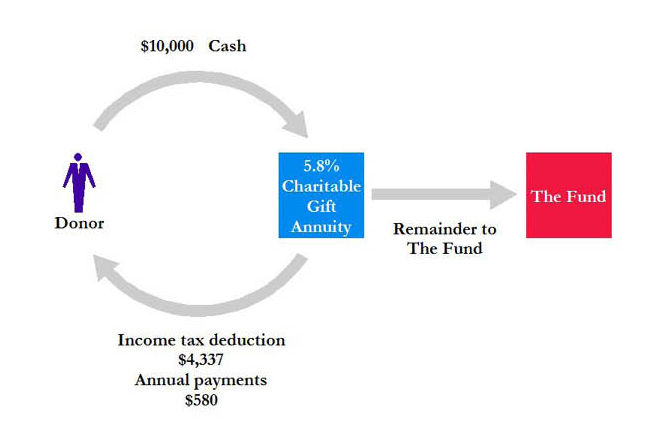

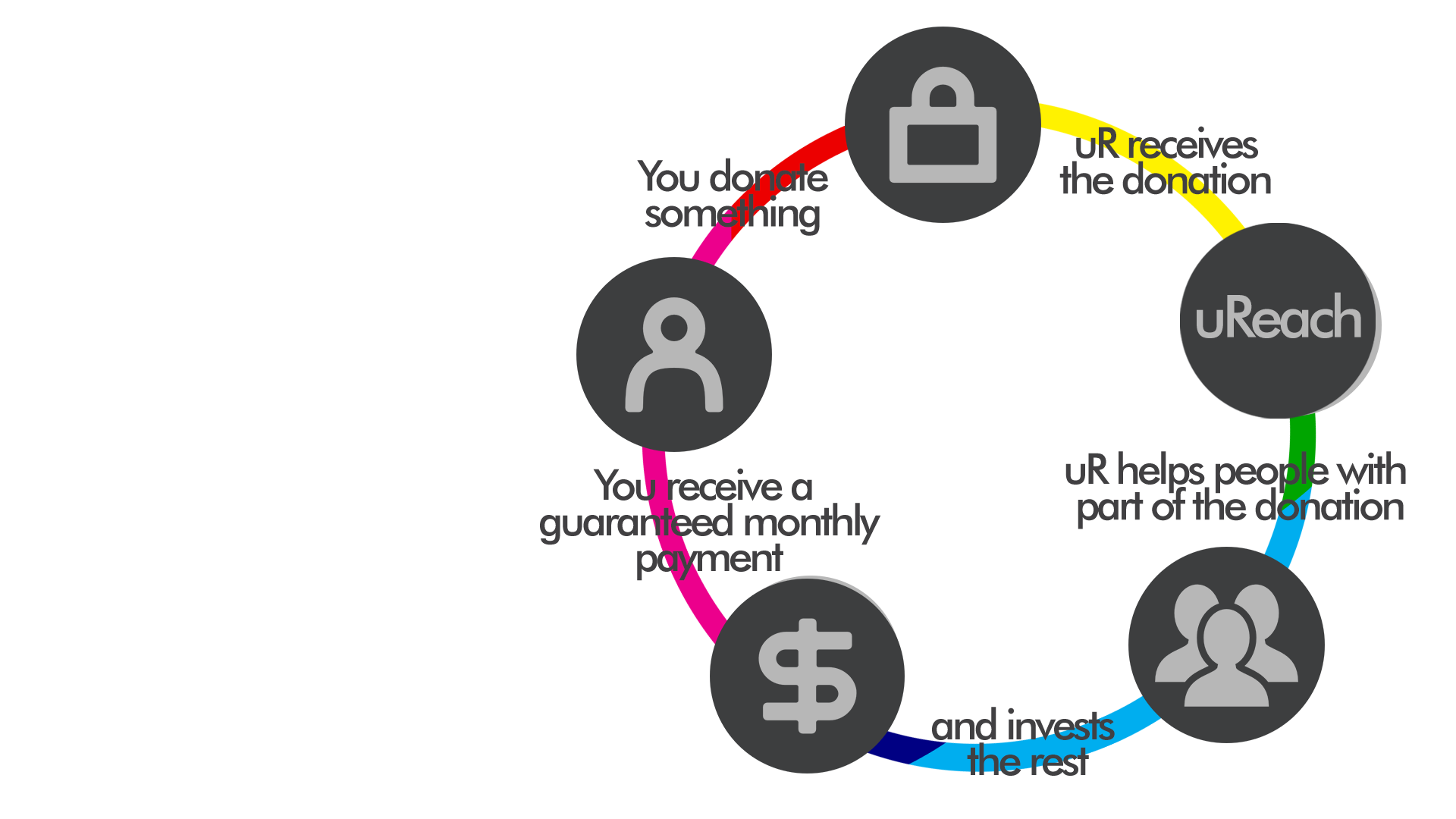

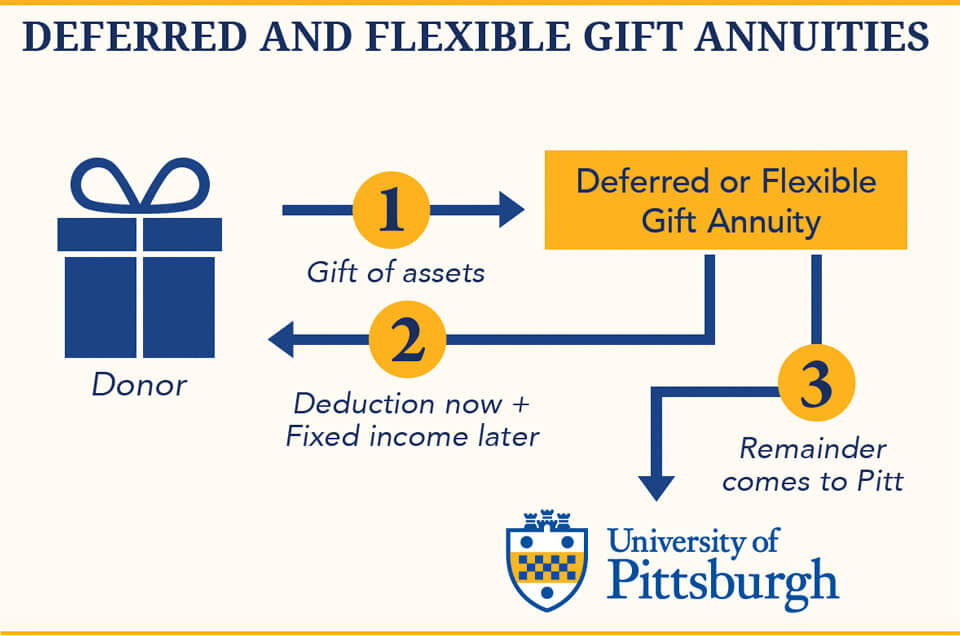

Ad Earn Lifetime Income Tax Savings. A portion of the payment is tax-free. A charitable deduction is available for a portion of your contribution on your income.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Most gift annuity donors are. 12 rows When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000.

The rate for a single 80-year. The minimum required gift for a charitable gift annuity is 10000. Creating a charitable gift annuity.

Minimum age to create a gift annuity. For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate of 78 paying 780 annually for the same. Charitable Gift Annuities are growing in popularity in todays low interest economy as a way to increase guaranteed lifetime income and benefit the church.

Gift annuities may be funded with cash or securities. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. 125 rows Multiply the compound interest factor F by the immediate gift annuity rate for the nearest age or ages of a person or persons at the annuity starting date.

If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. Give Gain With CMC.

City Of Hope Planned Giving Annuity

Charitable Gift Annuities Studentreach

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities Uses Selling Regulations

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuities Barnabas Foundation

Planned Giving St John S Episcopal Church

Charitable Gift Annuities Ureach Global

Charitable Gift Annuities The Field Museum

Charitable Gift Annuities The University Of Pittsburgh

Acga Charitable Gift Annuity Rates

Charitable Gift Annuities Suny Potsdam

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

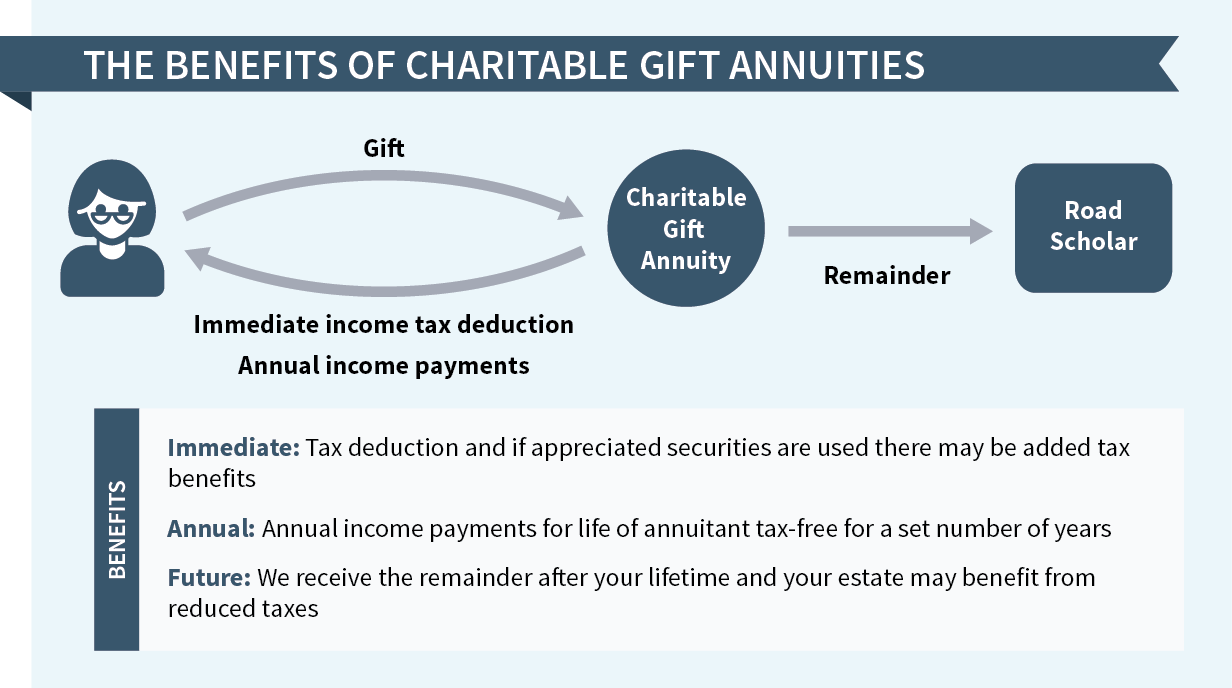

Charitable Gift Annuities Road Scholar